In an #EcoTradeWar with China(?) and Russia (?) over #ZeroCarbonCement!

Will another #Multinational Nepheline Syenite Cartel win over the US, by your simply ignoring the offering of private investment relief for #AffordableHousing where everyone gets a chance to live the American dream

In this Mining Magazines/Mining Investment, latest Issue of a US Mining Law of 1872 (supply side) Mining Matters Newsletter, please consider that a 1934 SEC sanctioned financial “DUMB MONEY” press has almost nothing to do with the political football of “ECO-Awareness” of today, or how it happened that a English MINING Magazin’E’ (singular), which is a very fine publication, simply asked an embarrassing question of the US, recently, as: “I say old chap, what ever happened to wholly American owned Mining Ventures?”

Other disturbing questions concerning a “Made in America” endorsement is that international competitors for our natural resources are very aware that MAGA monsters seem to be delighted with the direction their liar+leader has taken to further discredit VP Al Gores “hanging chad”warning about Global Warming Climate Change.

Always good for a laugh among a non-thinker no-nazi rally, even though the supporters of chaos had a hard time voicing their opinion on, “On China New Construction Technology that has shocked US Engineers!” Both in 3D printing 3D houses, before the Russians, and Europe, and such things as a tramway in elevated rail transportation in melting permafrost by pylons, to reach Tibet, technology my state of Alaska desperately needs.

Sorry, again, for not paying attention, but China grad students sent to Western Universities after the Cultural Revolution, to catch up with a developing technology, have not stopped their learning of what is possible, —especially what was in the future for reinventing concrete.

Asia was the first to use Geo-Polymer Cement to by-pass an outdated Portland Cement® when it came to what I am calling a pump-able Zero Carbon-Cement formula that made the danger of collapsing sea side structures, which made the Great Gorge http://en.wikipedia.org/wiki/List_of_largest_bridges_in_China possible.

Sounds foreign and somehow suspicious? Do some research to learn that China was the first to 3D Print a affordable house as their economy cannot match the 50% level of take home paychecks paid on rent or mortgages.

If you are a follower of a bleating band of sheep understand that those who quote dynamic “leaders” that purposelessly took the US out of the Paris Climate Change Accords, know that was an act of the Devil encouraging a cover-up that the manufacturing , by roasting, of Portland Cement that was known to produce 6 to 8 % (second after Transportation) of the World’s greenhouse gases.

Now that other industries have been trying to do their bit in clean air compliance, how can OPC which has been reaching a startling 10% worldwide level, when other industries have made it possible. Can’t you just hear that Sweden’s Greta Thunberg scolding with a simple, “Shame on Portland Cement®?

So, what can you do about all this? Start by actually thinking about the small business opportunities, following, to make money the fresh green way by investing in a healthy planets future. As follows. None, right now, of an IPO where the ROI have already been divided up between the “Good Old Boys!”.

This website, wherever you find it quoted without malicious Ai advertising distortion, was written just for you — a small individual investor who believes that fairness of in politics and business is the ultimate standard that made American great in the first place.

Yes, it is just as true about volcanic Lithium that Nepheline Yemenite (which no one seems to have heard off —other than China, Russia, and Belgium, and Canada) now has entered a "prospector's rush" to see who will win in the US, other than 3M in Arkansas, and myself, a simple prospector that started out at 16 years old, on the 1955 looking for Carnot (or yellow cake uranium) that the government paid us prospectors $10,000 to find. And a desperate government would allow the start-up project an Office of Minerals Minerals loan on 75% of the cost to develop that project, to be paid back at 5% out of production. If the project failed; it was forgiven.

So here I am well past retirement age being patted on the head and being forgiven, I guess by youngsters, for not understanding how this business reall works. Sorry, that I am the individual owner of ready to mine 250 Million tons of ready to process https://ZEROcarbon-Cement.com known to competitors as a replacement to a dirty, 10% greenhouse gas polluter, outdated formula of Portland Cement™ that has enough political power to win (unheard of by the public) a majority SCOTUS decision against the Teamsters Labor Union v: Quick Concrete loss of units, appeal.

I know full well that 250 million tons of equal value government measured in place Nepheline Syenite ore at a low cost $100 per ton is far too much of an investment, even at a continuing prospector's royalty of 5% and a minimum annually payment of $????. This is why I have broken down in-place ton units being distributed from a "new" owner position of ECO-Minerals-Stockpile as a Master Limited Partnership, a natural resource invention for oil pipelines, which will most likely grow with a "grubstaked" addition to take ZEROcarbon cement (an 84% into the holy grail of Global Warming Survival Following is an order form, from 2022, which I felt had a pretty good chance at surviving the competition's ability to cast a dark shadow over that of Nepheline Syenite. Unfortunately all the the following order form was directed to deceive. And alas my main product has been set back two years buy my buying into a complete diversion over, who actually owned, what.

Here is the sad thing. I have temporally lost two great URLs that no longer explain what the magic of Nepheline Syenite over that of an old-fashioned building material, as broken down as a flow-through business plan, no longer a valid —thanks to an effort to by two infiltrators working for the "man", until I have two floors of Mark Dryer lawyers, and an Arthur Anderson CPA firm.

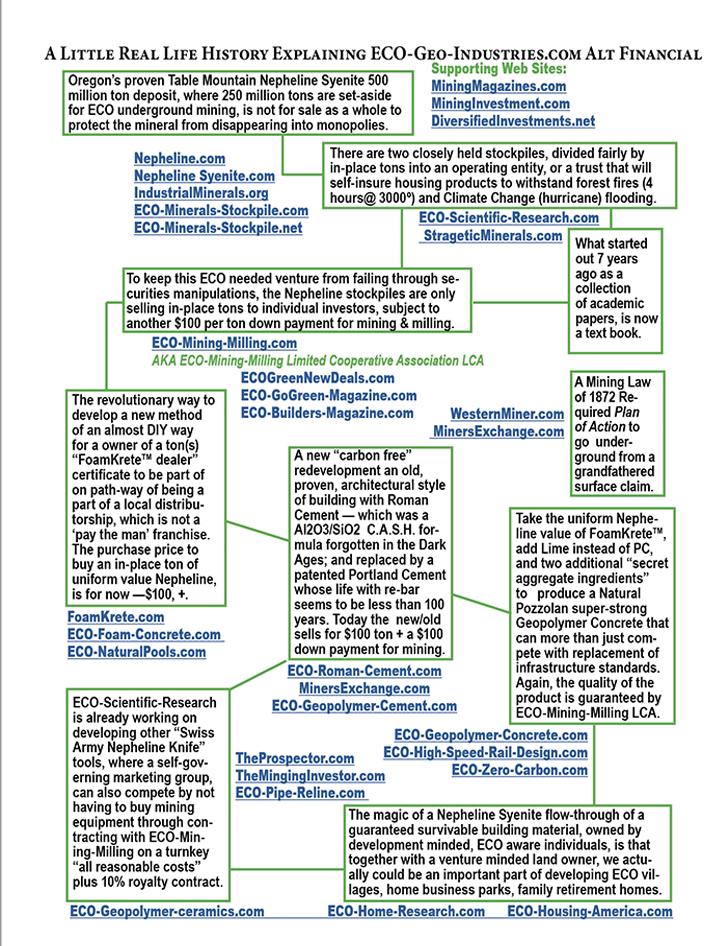

The flow chart that follows had active URLs, until those were mimicked — especially the "ECO-Minerals-Stockpile" by simple LLCs— and unauthorized, and unrecorded "ton units" were sold to someone, by MAGA agents! Know the unique Nepheline Syenite ore remains almost untouched, and ready for mining by contract by what could be salvaged out of a ECO-Mining-Milling Limited Cooperative Association, now totally defunct.

So, it is back to "TheProspector" being in-control of the Nepheline Syenite claims that are up to date , and ready to start operations of opening stage one on an accepted Letter of Intent, of reopening a grandfathered surface quarry (which should bring in enough investment to do the right thing of going underground (just as is done in Norway) as digging a big ugly pit, destroying a healthy US owned forest would be incredibly stupid as the angle of repose would limit the depth of "the pipe" that brought up a volcanic "sill" of what is a naturally formed protozoan, also identified as a ZEROcarbon-Cement.

As I do not trust the Internet anymore, and have been out in the field prospecting for an additional volcanic mineral (as is Lithium, that Asperger's Elon Musk is seeking to tie up a supply source for his EV vehicles, just as Asperger's Henry Ford developed a flow-through supply system), you may have to spend a little time reaching "TheProspector.com", going back into a almost 70 year old career, to come up with two separate, unknown minerals that react with the rare earths elements of Nepheline Syenite — which most likely will produce a superior ZEROcarbon-Concrete.com.

Renumber that the URLS that still lead you to the genuine URL actually lead to hundreds of pages of documentation. Just ignore responding to anyone other than claim-holder Barry Murray that has already suffered through verbal abuse that unfortunately is difficult to trace back to someone that can beheld accountable. Do not believe fake science from the people already proven wrong by thousands of Covid Deaths, and billions of dollars of "Climate Change Chaos" when simply following my www.FoamKrete.com thinking would have saved a lot of fire and flood insurance money lost... just like that!